bouncing off the bottom

sometimes it's a very short distance from high to low. In a few weeks where things seemed to be working out better than we could have planned them, it took us a bit by surprise. Things recently have seemed amazing. Our remodel project seems a success and has bookings, we have immense interest in zenbox and even have fun plans for the summer. Life is simply awesome! But it turns out we have been so focused on finishing our projects, getting the places booked, wrapping up the last wave ofaaaaaaa clients and finding the next wave that we hope to work with...that it simply snuck up on us from behind. Apparently, we're broke. In the red. Flat, broke and busted...

It's funny (though the word seems a bit inappropriate here) actually; I've halfheartedly been describing our last project to people as "dumping every last cent we have into it in hopes of finally making some money on the return", but as it turn's out we did exactly that. We have always had our "padding number" for comfort at the low end of our bank account and tried not to go below it (anywhere near it. We knew going in that this project would take us below that level to a new "uncomfort", but a few days ago when jen asked "did you pay the credit card bill?" it hit me. I had not. Not for a while. The fact that a new month had come and gone had somehow totally escaped me. Oops.

I grabbed the phone and pulled up our account to check the status, and for a second neither of us breathed. Ouch. We were not only past due, but had less money in all of our collective accounts than we had racked up on our credit card.

Hmm. So that's what zero feels like.

This is the type of thing that in my past life/brain would have broken me. Shattered me completely. The financial stress would have consumed me and I wouldn't be able to focus on anything else until it was solved. I would have run out the following morning, borrowed a suit and begged for employment even if it meant selling my soul to get it. Instead, I seem oddly calm about it. Make a plan...work the plan; that's what we do. Unless of course the plan changes in two weeks, which seems to happen quite often with us.

We knew when we quit our jobs that our finances would only last so long. We knew when returning to portland that what we had saved for our plan of two years on the road would deplete even more rapidly. We have paid close attention over the last 3 years (somehow almost 3yrs to the day) since we got our last paychecks and have watched the accounts slowly shrinking.

We pulled major funds out of my 401k for the garage remodel 2 years ago, knowing that while the fees hurt and it was an ill-advised move, the fact that it would allow us to live (arguably forever) without a rent/mortgage payment seemed like a fair and easy trade. We have been living an amazing life these past few years, but not without hard work and not without being both creative and strict. We still share 1 meal when ordering out, we share one phone between two people (that one usually gets the attention), and we almost never buy anything new until the old one is completely beyond repair.

Not clothes, not sunglasses, not tech toys...nothing. We have been selling furniture and design services in hopes of finding a way to make money while still enjoying ourselves and there has certainly been signs that the plan is working. We just got building permits last week for one client, we have another in the process. There are a few really exciting projects that we are awaiting/hoping fall into place and a few we are just seeing completed that we started long ago.

But... in recent weeks we've also been letting our guard down a bit. We are living on the floor in a construction zone without a kitchen so we find ourselves eating out more, enjoying some of the finer things (a few date nights, enjoying a weekend away complete with massages and even booking a few upcoming weekend trips with friends)..,

All in a bit of celebration to a hard fought few months and a job well done, and a bit because I think we are also beginning to realize that as much as we enjoy the minimal lifestyle we do occasionally long for some of those things. A nice meal at a fancy restaurant, a night out on the town, a massage or pedicure, even just a new pair of shorts or a skirt to replace the ones we've been wearing despite rips/holes for a few months. We haven't had those things for years and we certainly don't "need" them, but that doesn't mean we don't (or wouldn't) enjoy them!

After we rented MakerFlat we started to feel pretty good about our accomplishment and about the fact that we had a few weeks out rented and we let ourselves play a bit, which in turn made us realize we wanted even more. We still do... but now is clearly not (yet) the time. I had even begun to think about not taking zenbox clients and enjoying the summer as some downtime and playtime...but now it seems, is clearly not the best time. An odd turn of events in a year we set goals of being profitable, we seem to have pushed our limits the other way.

On the upside, we aren't panicing...that never helps. But we are sittining down and have some serious conversations about whats next and our direction moving forward. We have a bit more in my 401k but if we pull it out, once it's spent - we're done. Capput. Game over. We don't come from families that can serve as a backup plan for us (not that we would accept it anyway), there's no slush fund or pot of gold out back. We have literally no other source of funds to tap into. If this plan of our doesn't work, that's it. We go get... jobs.

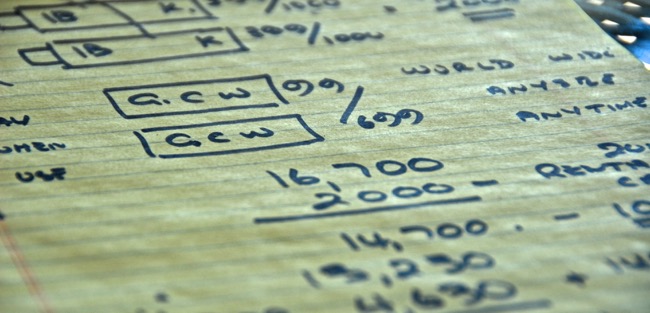

Obviously we started with a credit card payment (the first one in over 15years that didn't pay off the account in full), then we pulled out the spreadsheets to talk brass tacks. To see how many outstanding bills we had out there, both coming and going. To see what we could safely expect in coming months. To see how long it would take us to payoff the remainder of our credit card bill, and what comes after.

Obviously we started with a credit card payment (the first one in over 15years that didn't pay off the account in full), then we pulled out the spreadsheets to talk brass tacks. To see how many outstanding bills we had out there, both coming and going. To see what we could safely expect in coming months. To see how long it would take us to payoff the remainder of our credit card bill, and what comes after.

There were some easy answers and some more difficult ones. We will clearly keep living in the studio (construction zone floor) and inviting guests to stay in our finished spaces. We will clearly be taking on a new round of zenbox clients and we will be careful about exactly how much we allow ourselves to play and to spend. It sounds like tough love, and some might say that our lifestlye isn't worth it... but to us it still is. I know, because we asked each other - personally and together. And to us it's a no-brainer. This life were living is still a blast. It has its setbacks and we have to watch what we spend and occasionally have to do without...but we also know well the alternative. And we are a long...long way from going out and looking for full time jobs that would solve whatever minor inconveniences we deal with now.

We believe in this path that were on, and we believe that we'll make it. That we'll soon be back to even, then back to saving money in order to finish out the studio... and then at some point after that we'll actually be thriving. We think. We still have faith at some point in the future we will find ourselves making enough passive income that we can both go get those pedicures and massages AND talk about not taking on any clients for the summer to go and play.

We are still pushing hard for those days and know we will get there. Because it's our dream, and frankly, that's the only answer we're willing to accept.